How to enable and disable SMS notifications for a Thai bank account

March 16, 2023

Table of contents

1. Notifications types for Thai bank account

2. What are the ways to enable or disable SMS notification for a Thai bank account

3. How to disable SMS alerts for a Thai bank account at an ATM (SCB as an example)

4. How to disable SMS alerts for a Thai bank account at an ATM (Krungsri as an example)

5. Abroad I cannot receive SMS notifications from a Thai bank

6. How to set up receiving SMS notifications from a Thai bank abroad

Notifications, including SMS, inform about the receipt of money in a bank account, as well as spending money (for example, withdrawing cash from an ATM or online purchases) and logging into a banking application (into a mobile application for online banking). This article will tell you how you can connect and cancel SMS from a bank account opened in Thailand.

Notifications types for Thai bank account

There are three types of alerts:

- Mobile app Push notifications

- Notifications about the entrance to the application and the movement of funds by email

- SMS notification of receipt or expenditure of funds

The first two types of notifications (Push notifications and email) are usually set up in a mobile application without any problems and work for free, although there are some minor nuances. For example, in Krungsri it is impossible to disable push notifications (this setting is just missing), and in SCB you can both enable and disable push notifications, but they do not work, that is, they do not appear in any case…

As for SMS notifications, this is a paid service. Its cost is 19-20 baht. It is impossible to disable and enable SMS notifications through the mobile application – this setting is missing.

What are the ways to enable or disable SMS notification for a Thai bank account

You can manage SMS notifications in the following ways:

1. Come to the bank branch and ask to turn on or turn off the SMS about the movement of funds in the bank account. Take your passport and Passbook with you.

2. Call the customer support number. You will need to provide your personal data and, possibly, additional information known only to you (for example, what were the last transactions made with funds in a bank account).

3. Using an automated teller machine (ATM). This method can be used only by those who, when opening a bank account, also received a bank card. If you saved on annual maintenance and opened a bank account in Thailand without getting a bank card, then you will need to choose one of the previous methods.

How to disable SMS alerts for a Thai bank account at an ATM (SCB as an example)

As I said, push notifications do not work in SCB (Siam Commercial Bank) and email notifications somehow work incorrectly. Therefore, I decided to enable SMS alerts using ATM.

Please note that in order to manage services, including enabling and disabling SMS alerts, you need an ATM of the bank where you have a bank account.

The following shows an example of enabling an SMS alert for a Thai bank account in an ATM (ATM)

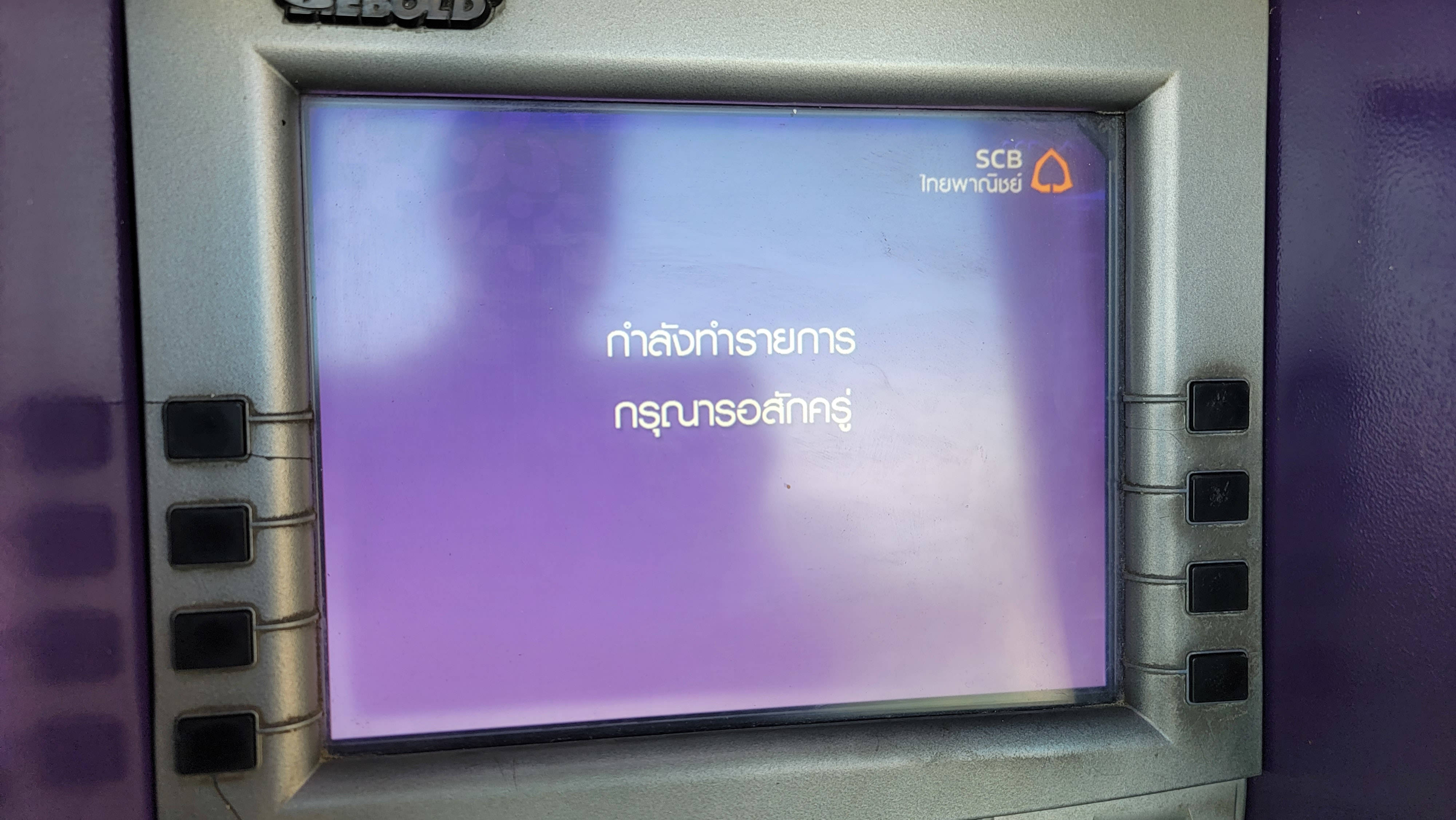

Insert a bank card.

Wait for the prompt to enter the PIN code and enter it.

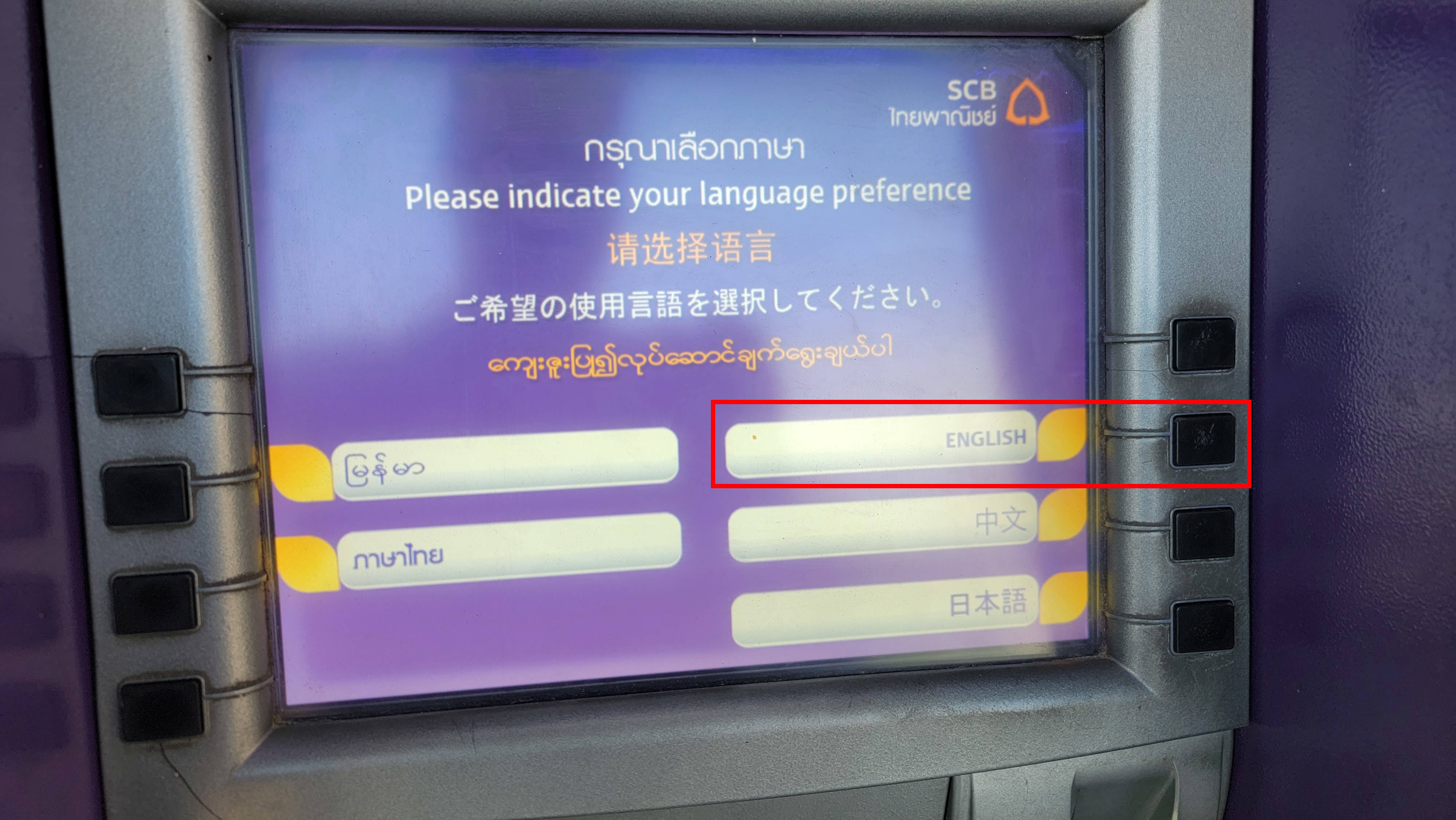

Select “English”.

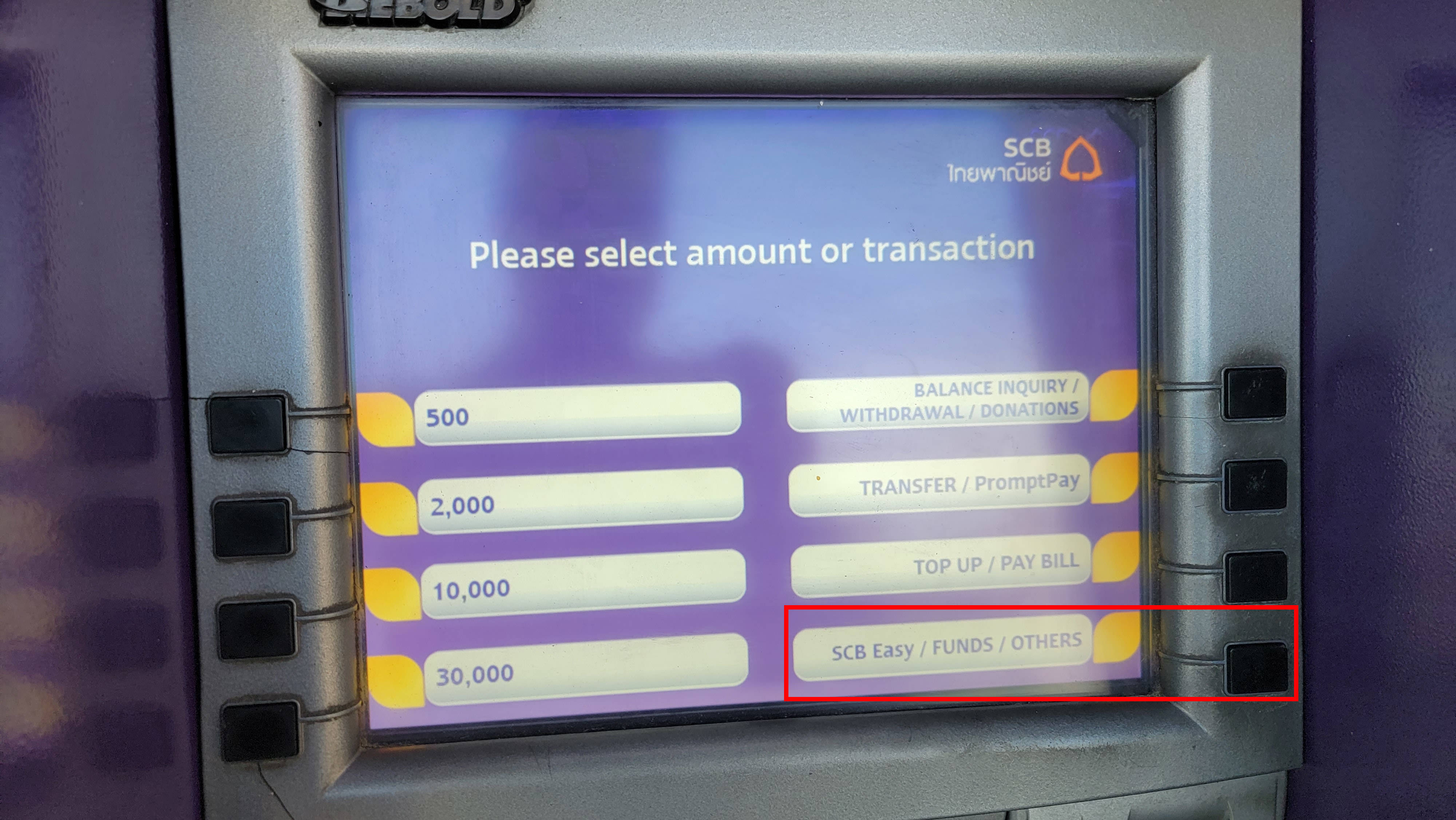

Select “SCB Easy / FUNDS / OTHERS”.

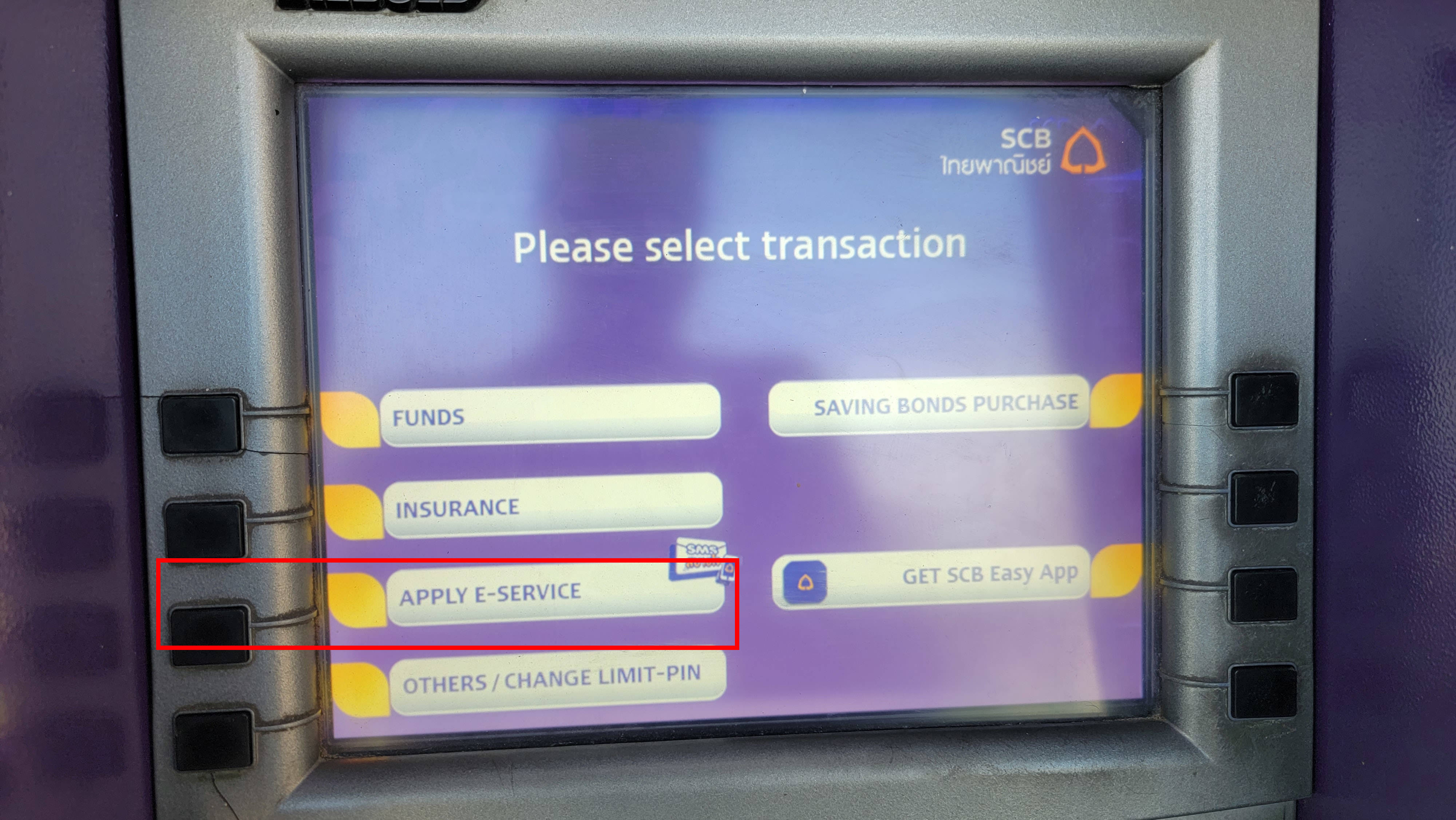

Select “APPLY E-SERVICE”.

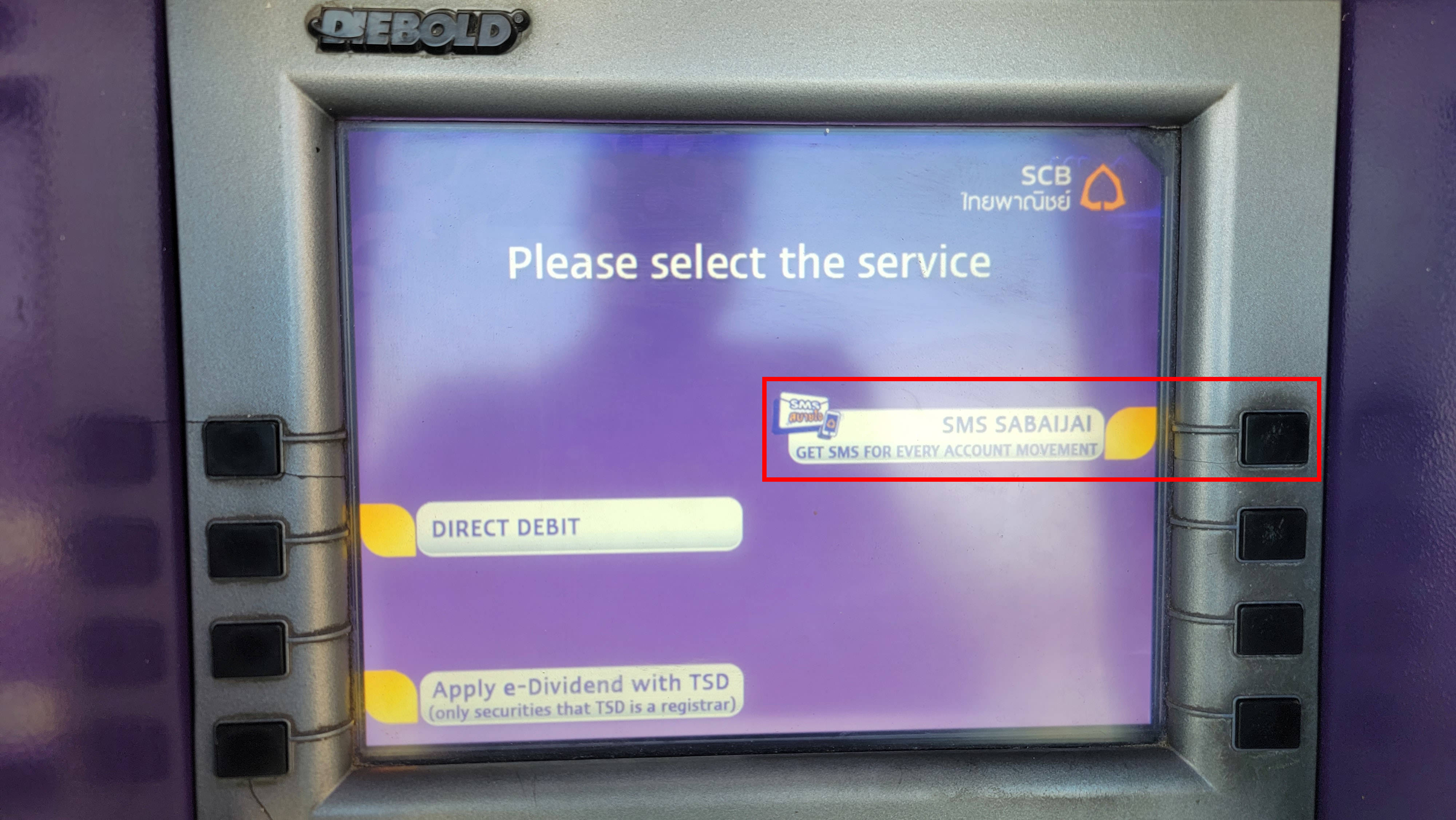

Select “SMS SABAIJAI”.

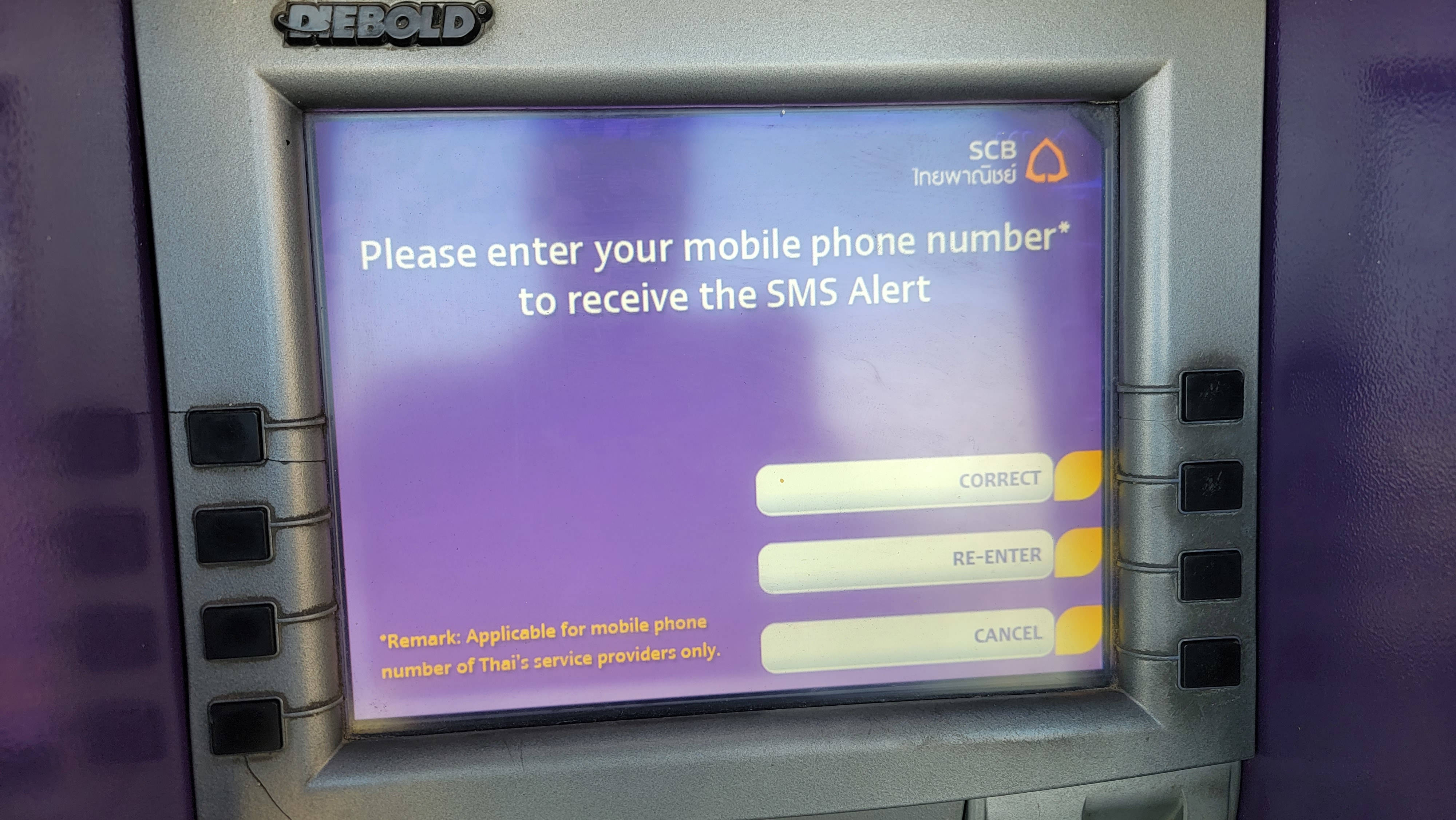

Enter the phone number to which you want to receive SMS notifications. Please note that you can only use a Thai phone number.

Click “CONFIRM”.

Select “Monthly”.

You can change things if you want (click “EDIT” to do so), but the default settings are quite optimal and should suit most people.

By default, you will receive SMS notifications about both the receipt of funds to the bank account and the spending of money. Once a week, you will receive an SMS with information about your current balance.

Select “CONFIRM”.

Everything is ready – take your bank card.

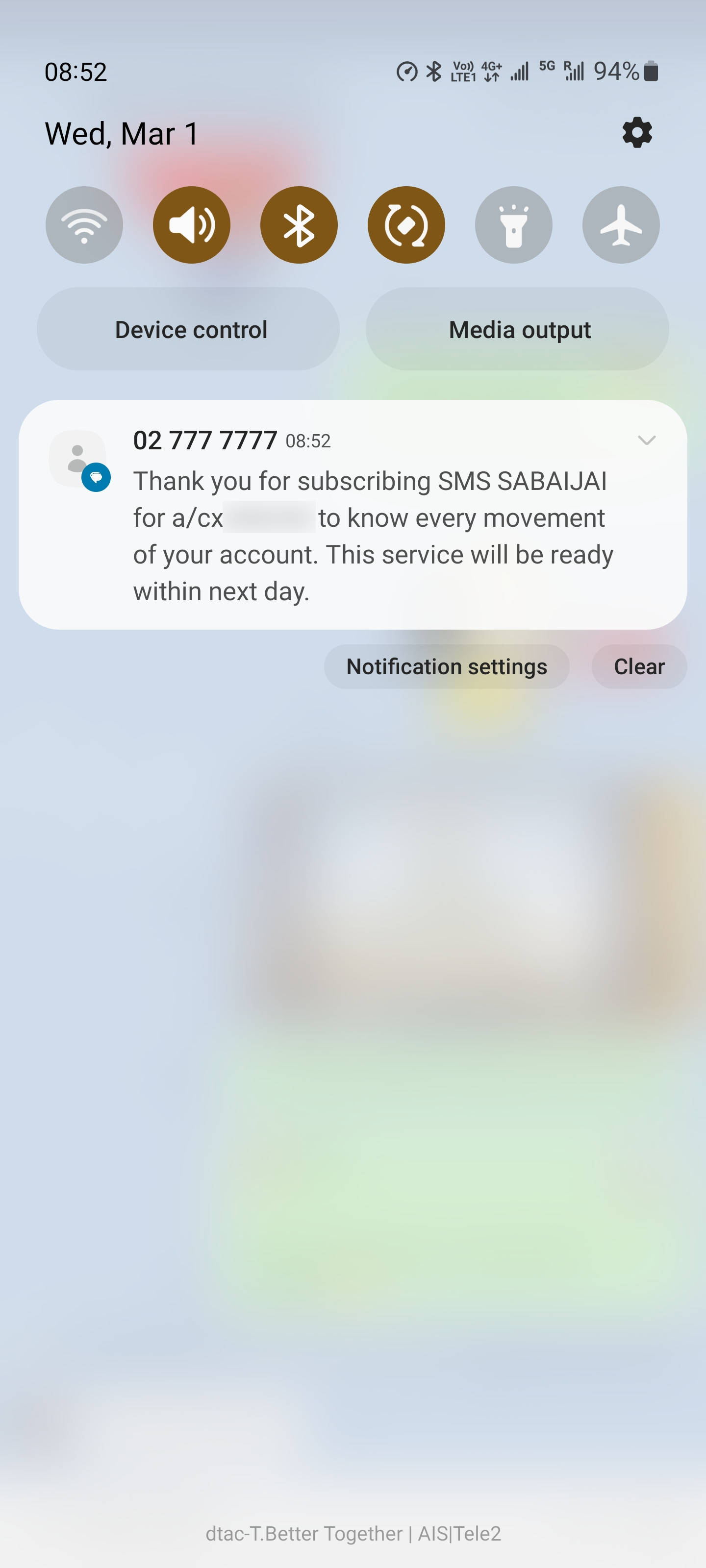

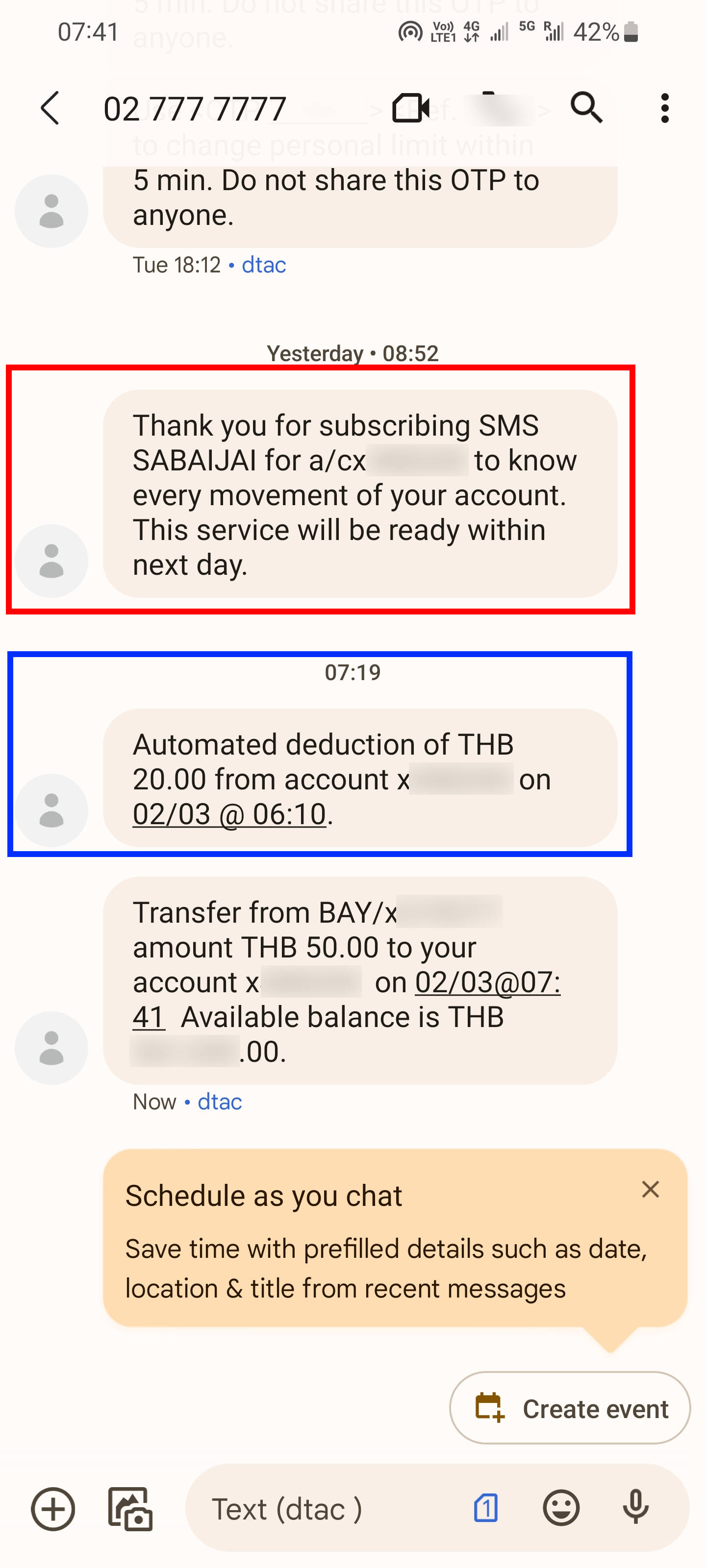

After enabling the SMS notification at the ATM, you will receive a confirmation SMS. Also in the SMS message it is said that the service, in fact, will be turned on only the next day.

The next day, the first SMS notification really came. Namely, the deduction for the payment of the SMS notification service. At SCB, the cost of SMS alerts is 20 baht per month.

How to disable SMS alerts for a Thai bank account at an ATM (Krungsri as an example)

Please note that in order to manage services, including enabling and disabling SMS alerts, you need an ATM of the bank where you have a bank account.

The following is an example of disabling SMS notification for a Thai bank account at an ATM.

Insert your bank card into an ATM and enter your PIN.

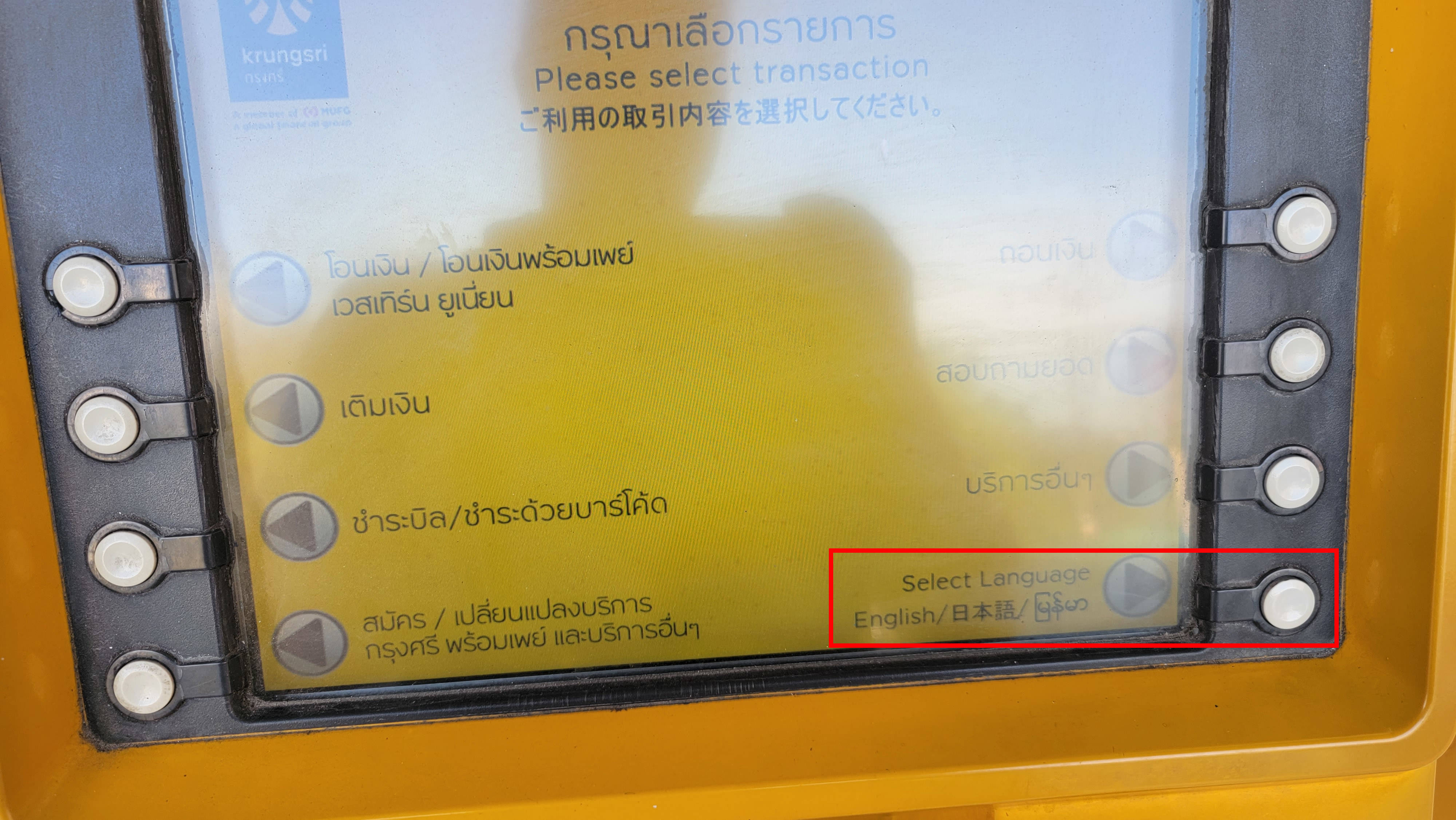

Click “Select Language”.

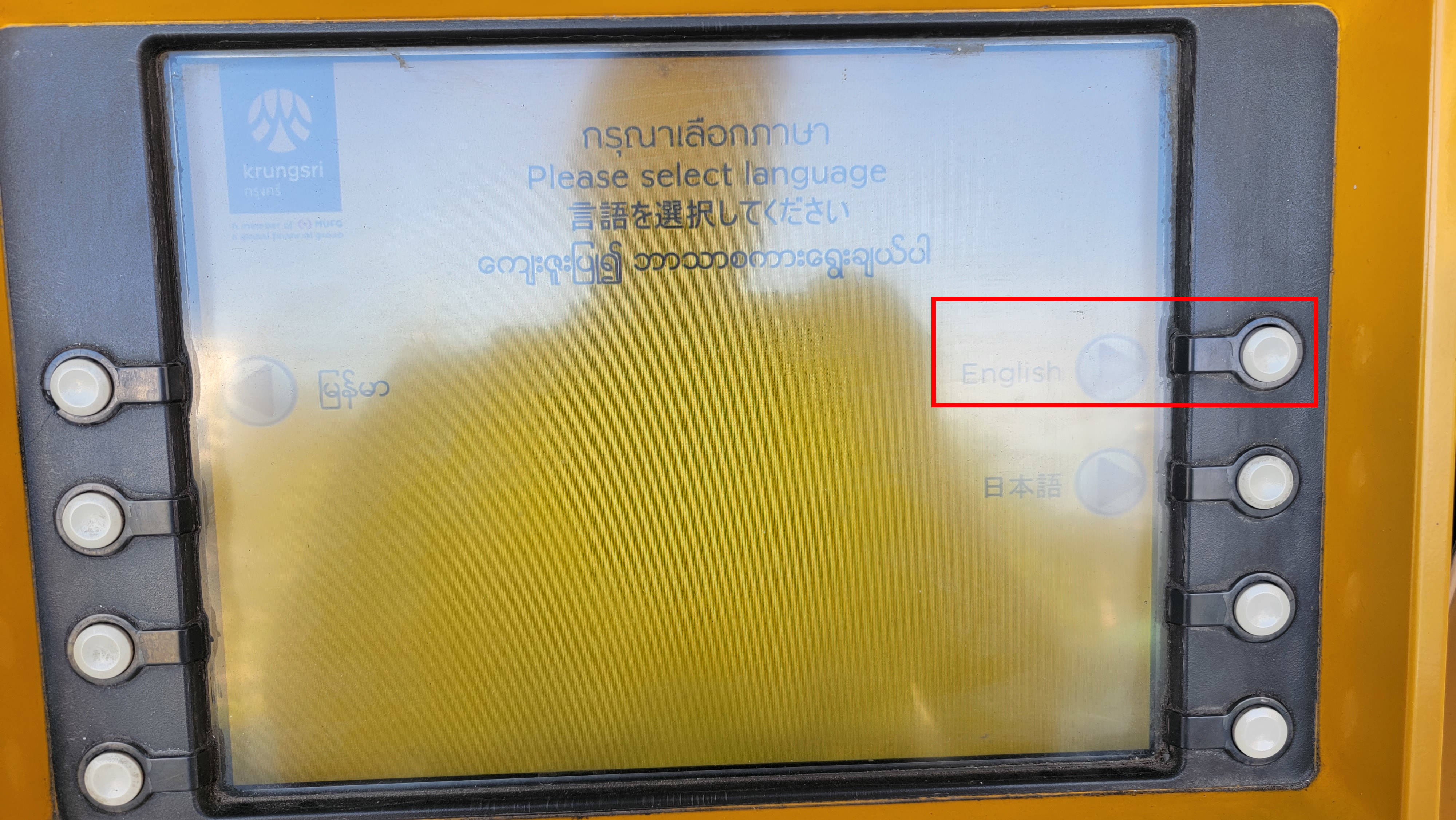

Select “English”.

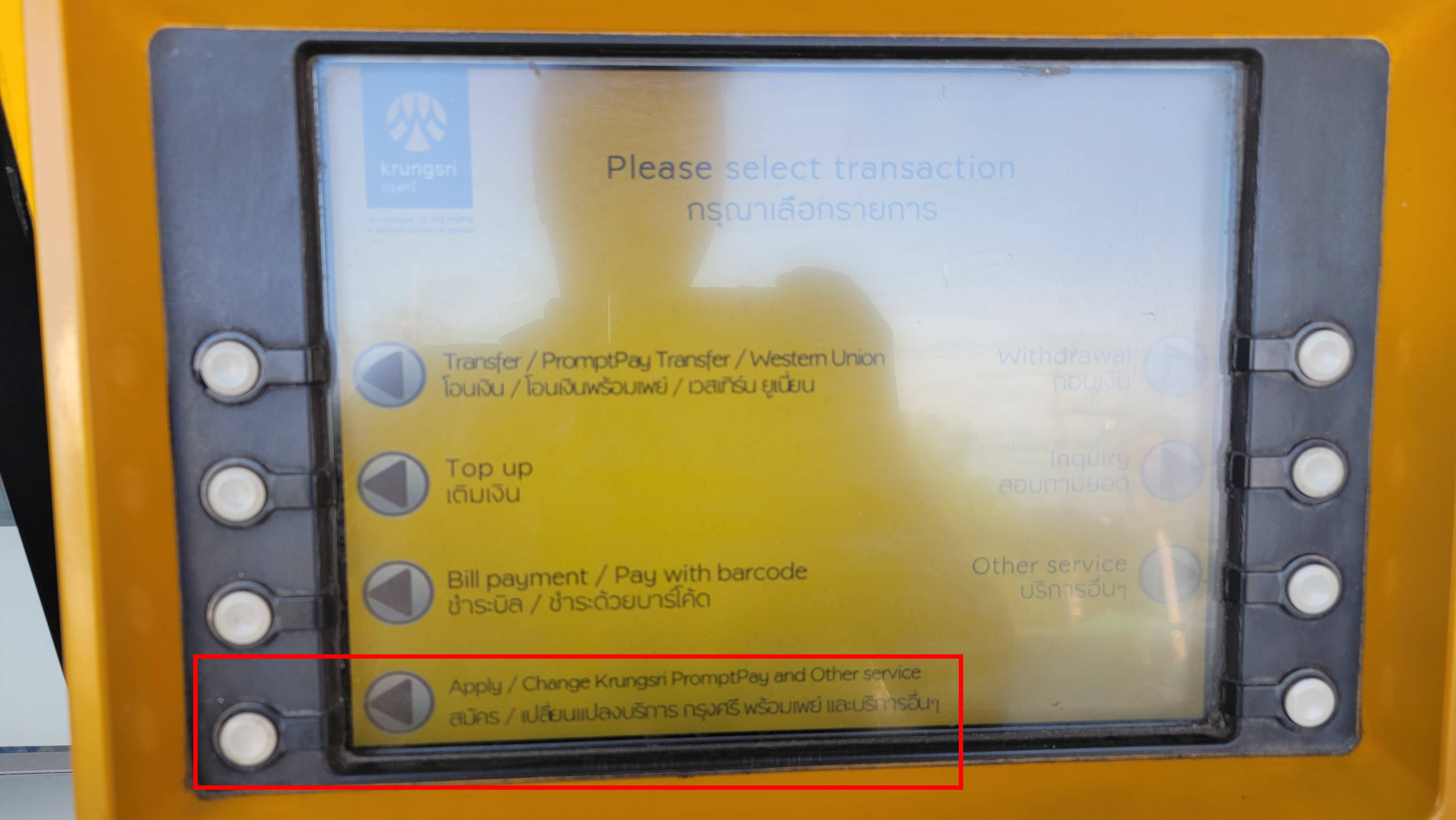

Select “Apply / Change Krungsri PromptPay and Other service”.

Select “Mobile Phone / SMS”.

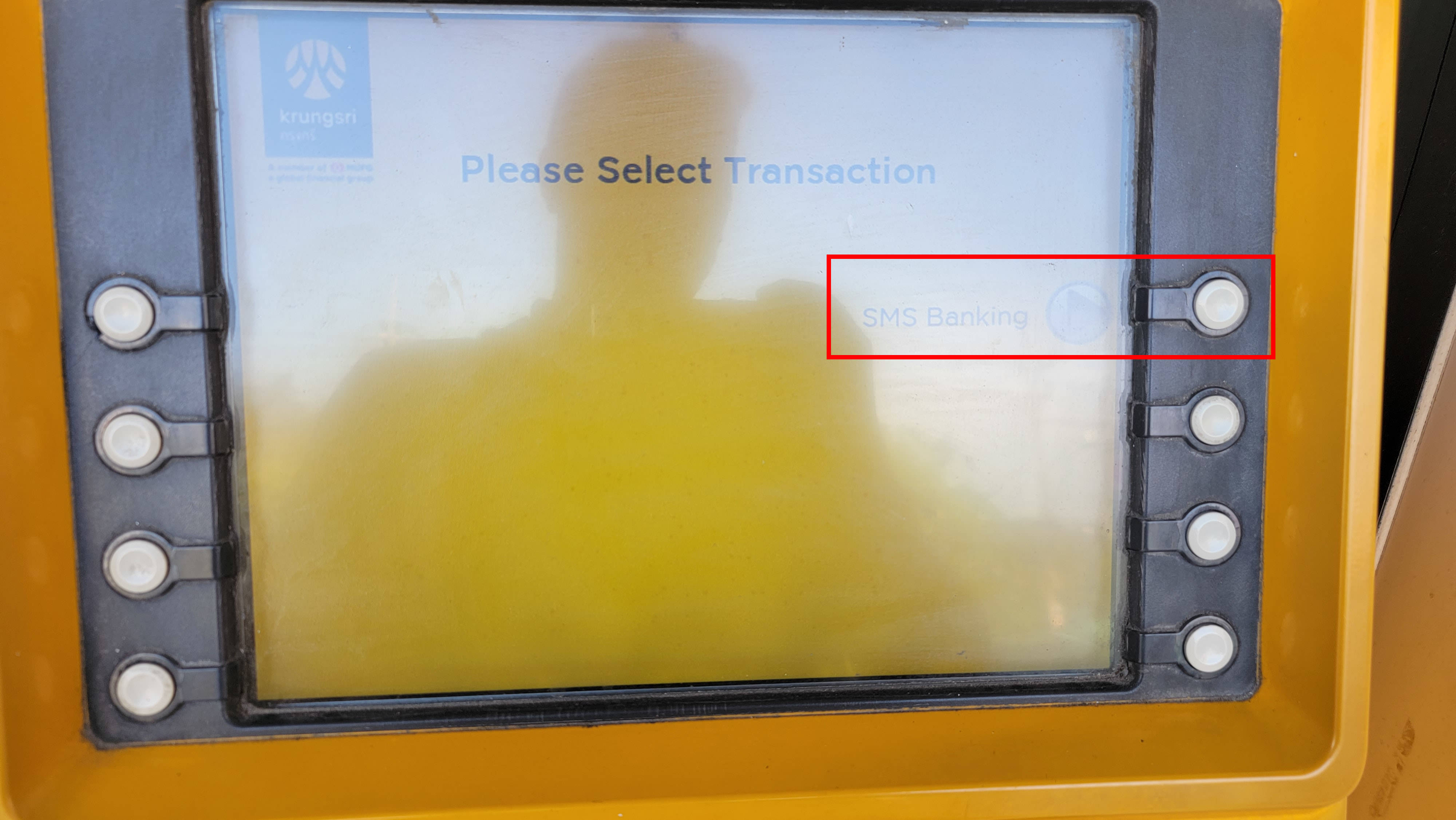

Click “SMS Banking”.

Select “Cancel Service”.

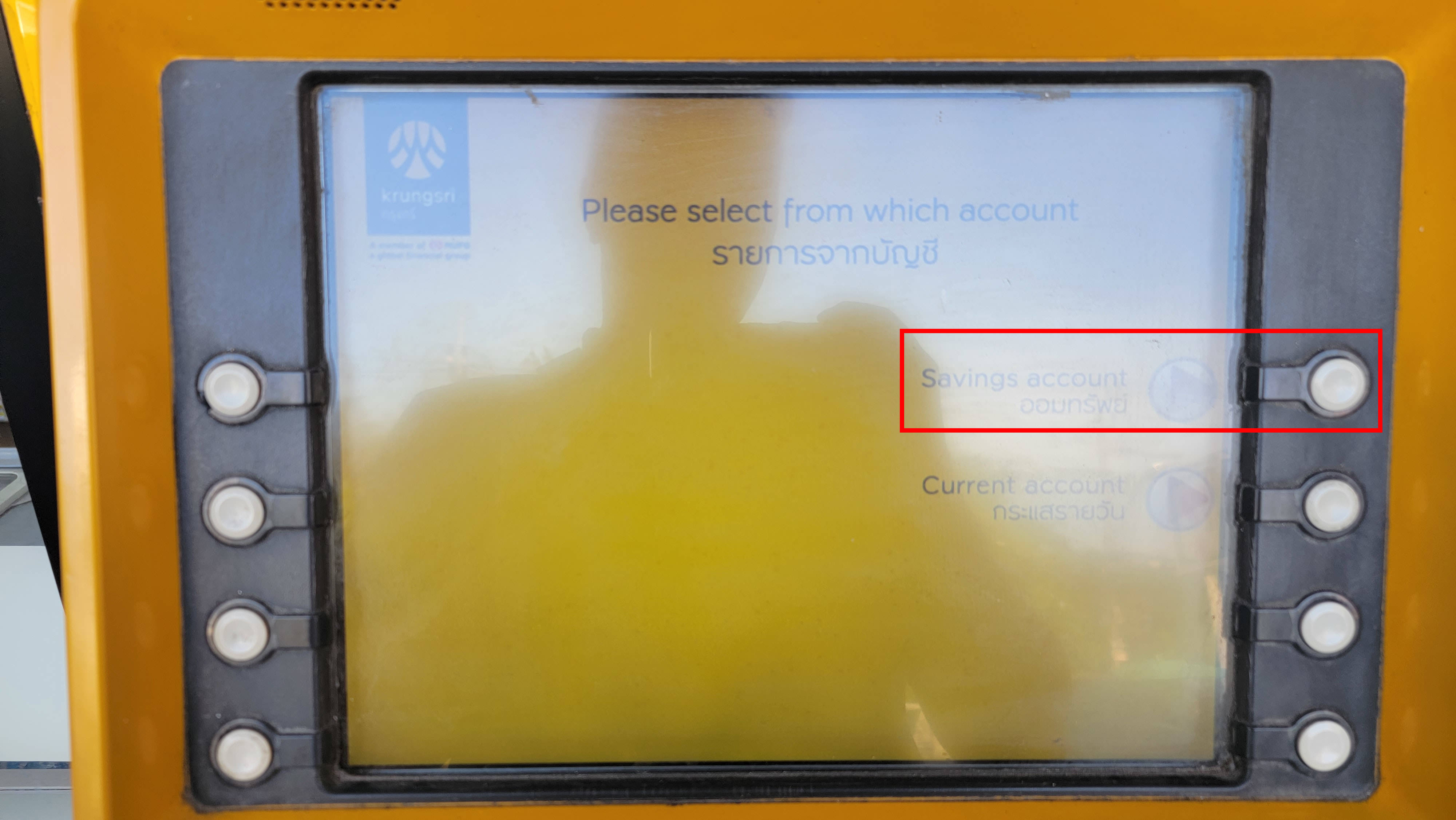

Select “Savings account”.

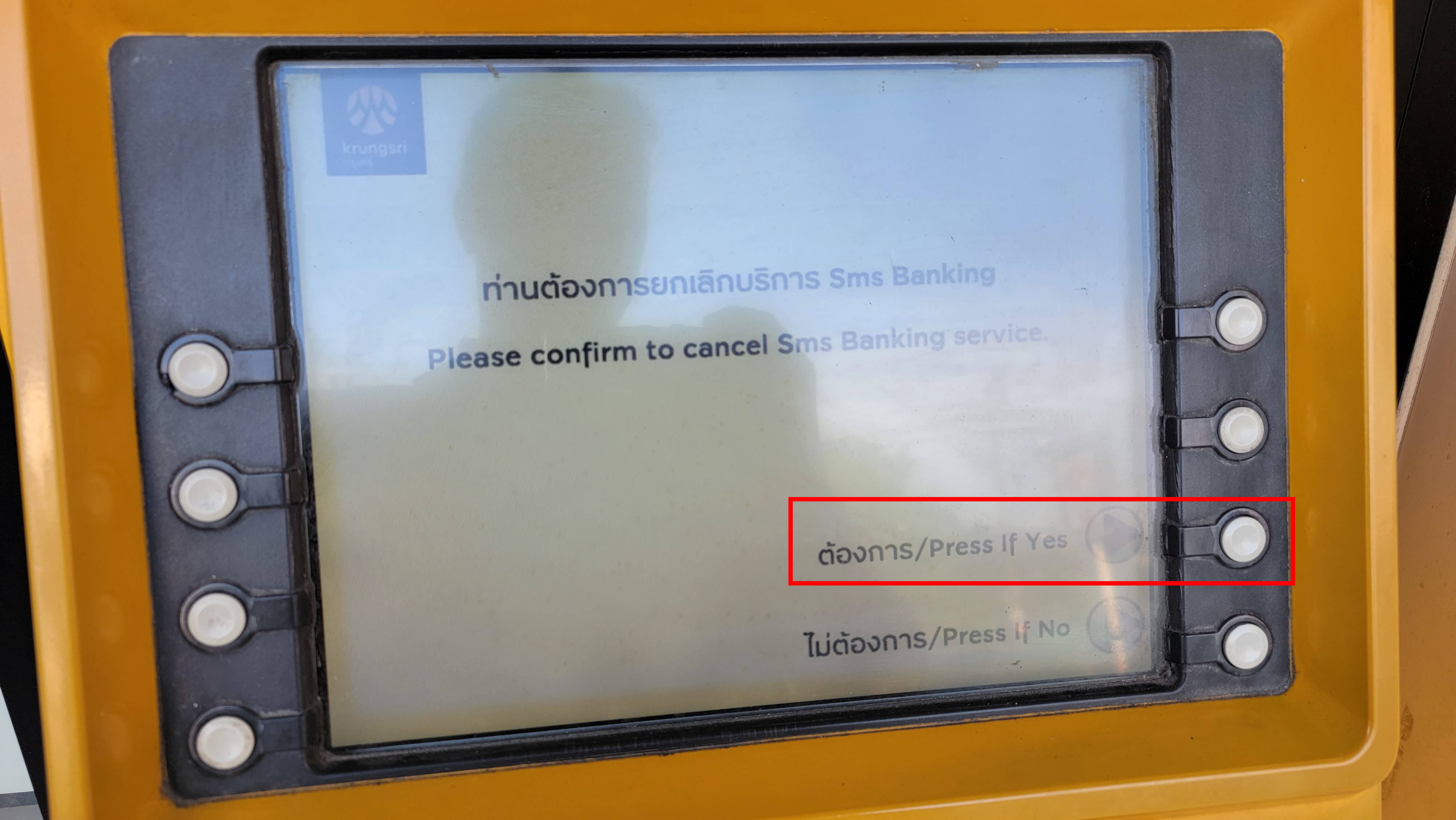

Select “Press if Yes”.

And… the operation failed:

Selected transaction or selected account is invalid. Do you want to continue?

I repeated the steps several times, chose a different account type, tried other ATMs, but always got the same negative result.

Apparently, to disable SMS notifications in this bank, you need to come to the bank's branch, or call the customer support number.

Abroad I cannot receive SMS notifications from a Thai bank

International roaming is disabled by default for Thai phone numbers. If international roaming is disabled, then abroad you will not be able to use a Thai SIM card, including receiving SMS notifications from the bank.

See articles for details:

- How to enable international roaming in AIS

- How to enable international roaming in TrueMove

- How to enable international roaming in dtac

How to set up receiving SMS notifications from a Thai bank abroad

SMS messages in international roaming are free. You can also receive push notifications and email notifications for free.

To receive SMS messages about the movement of funds in your bank account, you need to set up international roaming. For information on how to do this for various Thai mobile operators, see the links just above.

Tickets for buses, ferries and trains, including connecting routes:

Air tickets to international and local destinations at the lowest prices:

Related articles:

- How to enable online shopping in SCB. Why doesn't my SCB card work for online payments (SOLVED) (90.8%)

- How to open a Thai bank account with a marriage visa (on the example of SCB) (85.7%)

- Why does Krungsri bank card not work for online purchases and for cash withdrawals abroad (SOLVED) (83.5%)

- How to register for PromptPay at Siam Commercial Bank (SCB) (81.7%)

- Facial identification for transfers over 50,000 baht in Thai banks (79.3%)

- How to update passport information at a Thai bank (RANDOM - 69.2%)