How to use ATMs in Thailand

December 5, 2022

Not everything that looks like an ATM is an ATM in Thailand

In Thailand, on the street, in addition to the actual ATMs, you may come across machines for receiving payments. For example, in this photo there are two ATMs and one Internet service provider payment machine.

By the inscription “ATM” you can always distinguish ATMs from machines for receiving payments and street electric scales.

Various types of ATMs

Not every ATM in Thailand can withdraw money! Some machines are designed to deposit (drop) money into a bank account (you only need to know the account number for this, a bank card or other documents are not needed), and some are designed to update Passbooks (passbooks that are popular in Thailand).

Look at this photo – 4 ATMs of one bank:

- Passbook update

- ATM – ADM – withdrawal and deposit of money

- ATM – withdrawal only

4 ATMs of another bank:

- ATM – withdrawal only

- ATM+ – withdrawal and deposit of money

- ATM+ – withdraw and deposit money, update Passbook

The following example of four ATMs of one bank:

- Cash Deposit – depositing cash into a bank account

- Passbook Update

- ATM – withdrawal only

And 3 more ATMs of another bank:

- PUM – Passbook update

- CDM – ATM – withdrawal and deposit of money

- ATM – withdrawal only

So let's recap.

- ATM and ATM+ can be used to withdraw cash

- ADM, CDM, and ATM+ can be used to deposit cash

- Passbook Update, ATM+ and PUM can be used to update Passbook

If you need to withdraw cash, that is, to receive Thai baht, then be guided by the following information:

- among ATMs, look for those with the inscription “ATM”, they allow you to withdraw cash

- lone ATMs are always “regular” ATM cash withdrawal machines

- if there are several ATMs of different banks, as in the photo just above next to 7-Eleven or as in the next photo, then they are all designed to withdraw cash

How much cash can you withdraw at a time from an ATM in Thailand

Typically, ATMs allow you to withdraw 30,000 baht in one transaction.

If you cannot withdraw this amount, then the restrictions may be on the part of your bank – some banks set a one-time or daily limit on the funds that a bank client can withdraw abroad. To clarify this limit, or change it, you need to contact your bank's support service.

If you have a Thai bank card, then the limit on the amount of cash that can be withdrawn in one day can be set and changed in the online banking application.

How to withdraw cash from ATMs in Thailand

Below will be shown examples with photos of cash withdrawals from two Thai ATMs. Regardless of the bank, the algorithm is similar everywhere:

1. Switch the language to English or another familiar to you

2. Select “Withdrawal”

3. Select amount and withdraw cash

If you want to enter the amount, and not choose from the suggested ones, then the steps are as follows:

1. Switch the language to English or another familiar to you

2. Select “Withdrawal”

3. Press “Enter Amount"

4. Select “Savings Account”

5. Enter the desired amount

Example of cash withdrawal using the example of Krungsri bank (yellow bank)

1. Insert a bank card and wait for the prompt to enter a PIN code.

2. Enter your PIN.

3. Press “Select Language”.

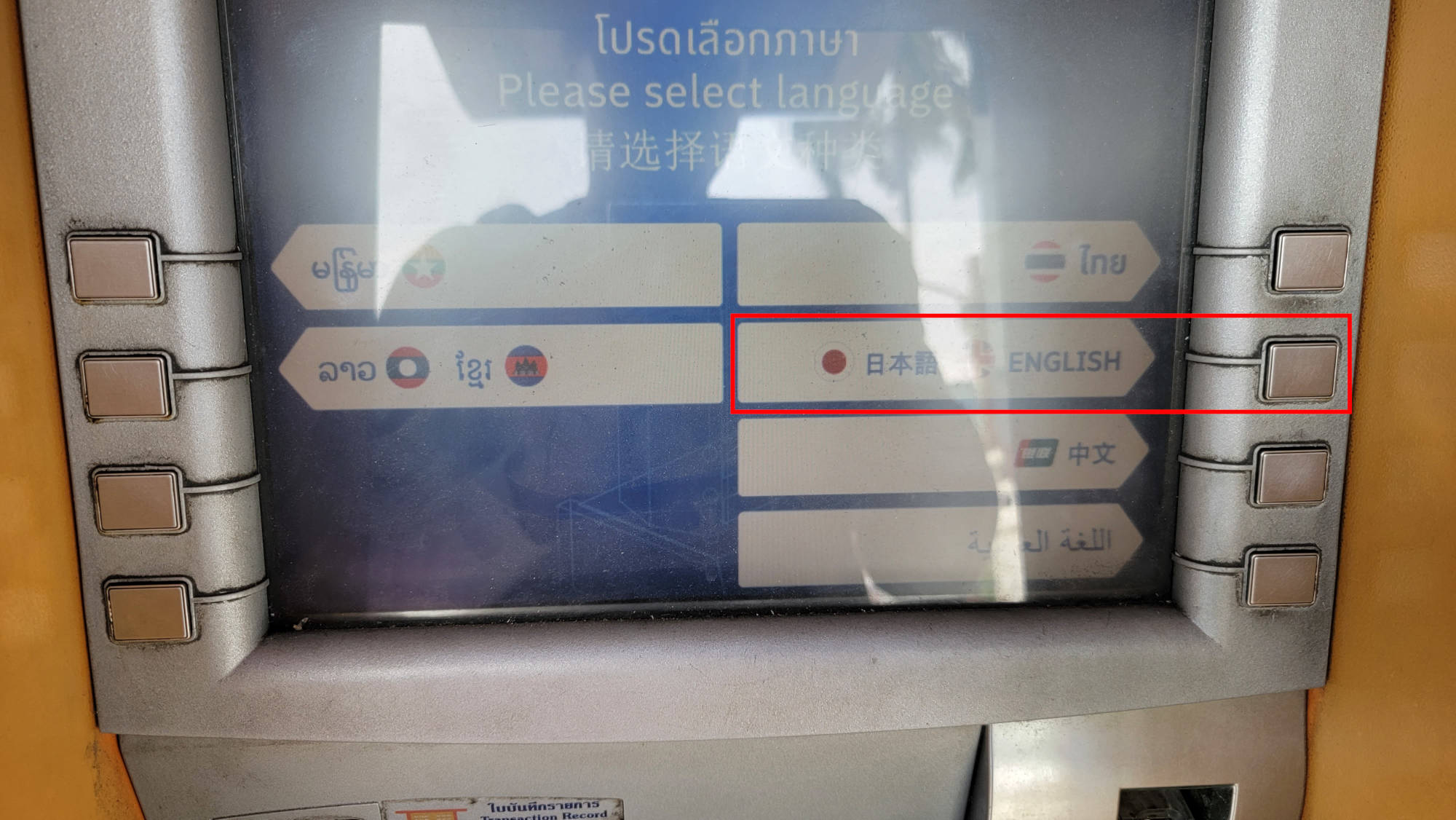

4. Select “English” or another language you know.

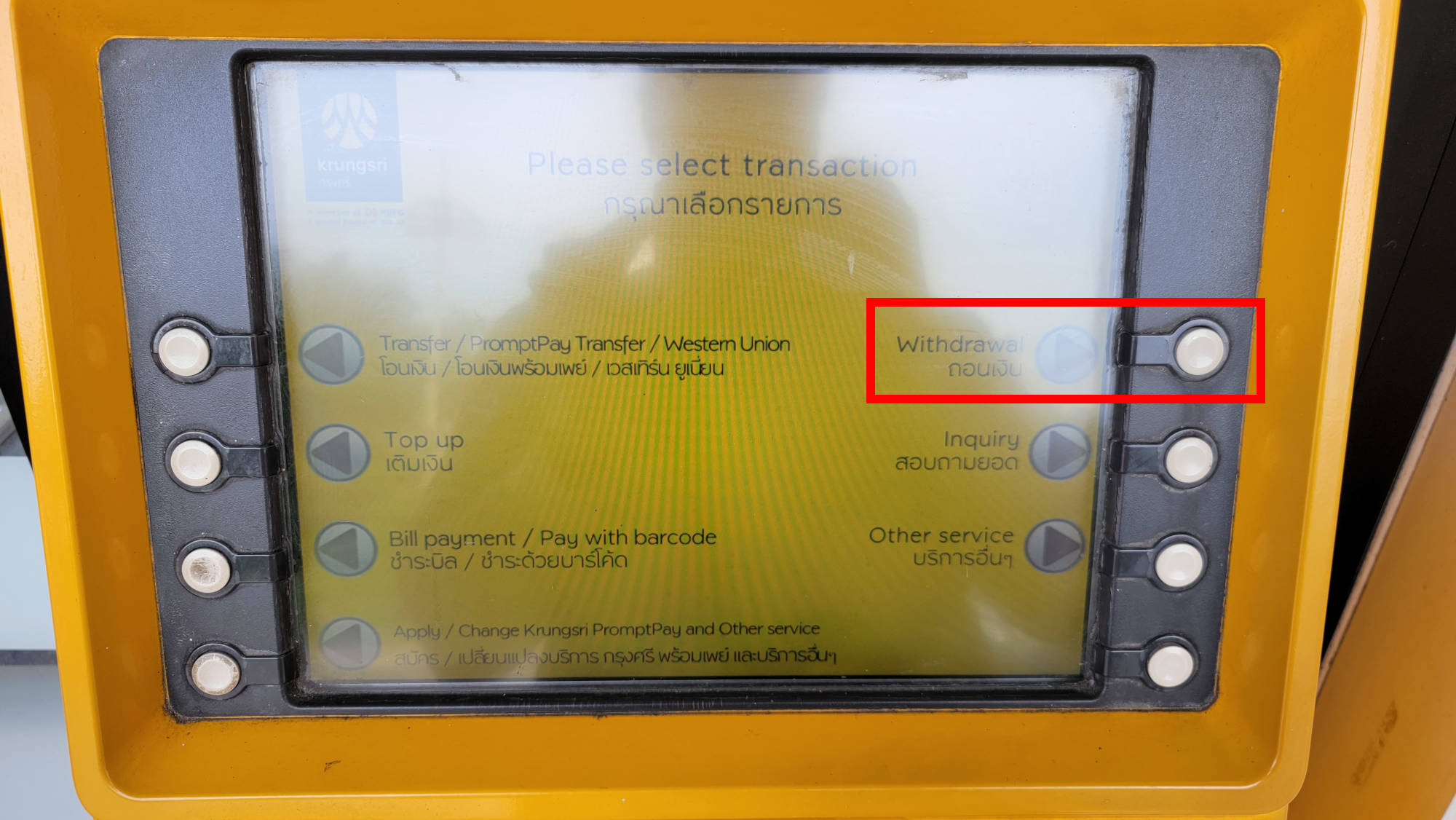

5. Select “Withdrawal”.

6. At this stage, you can either choose the amount and withdraw cash (work with the ATM will be completed). If you want to withdraw another amount other than the offered amounts, then press “Enter Amount”.

7. Select “Savings Account”.

8. Enter the amount you wish to withdraw. Click the “Correct” button.

9. Wait for the ATM to complete its work.

10. Take your money.

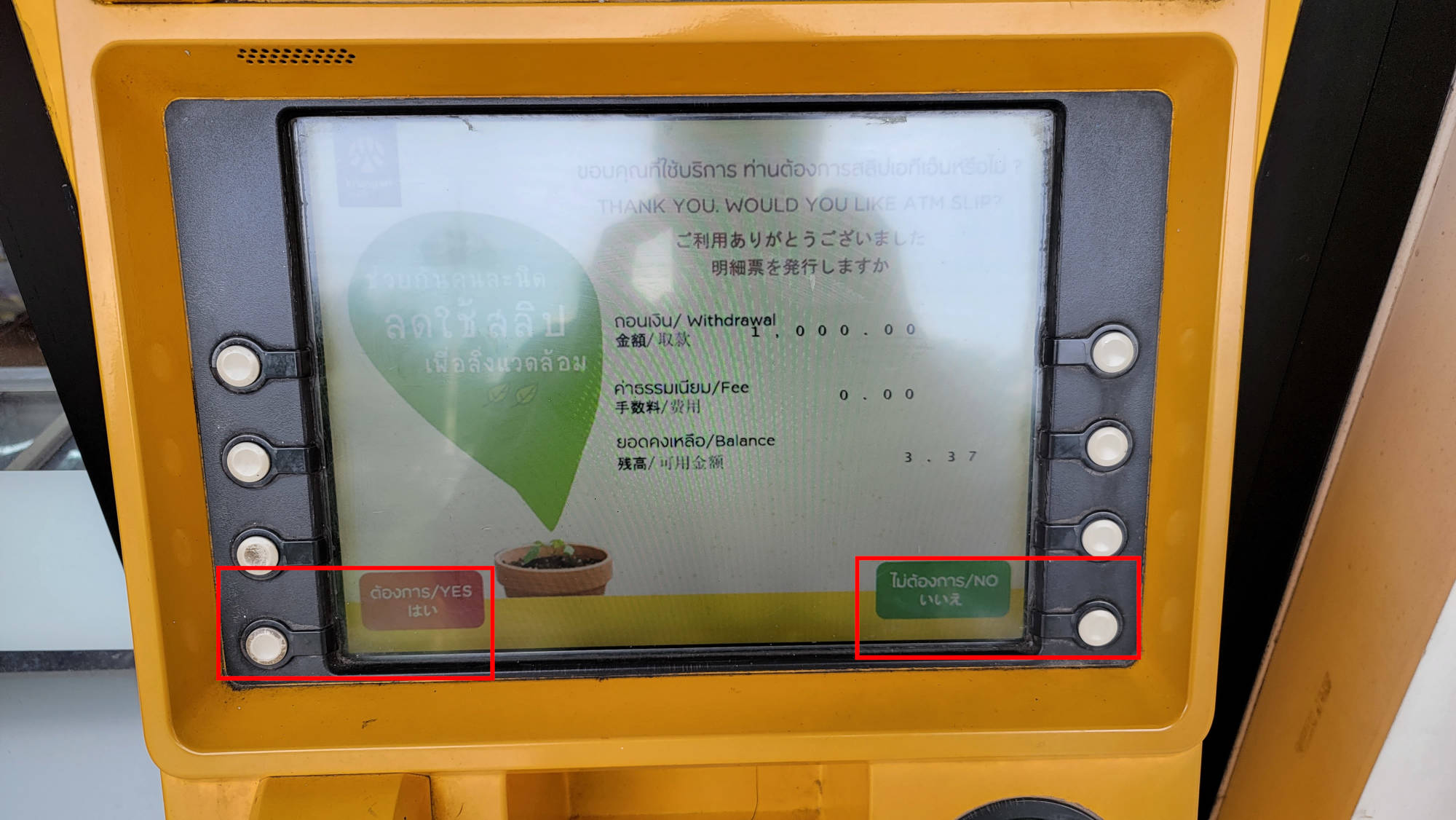

11. If you need a receipt, click “Yes”, if you do not need a receipt, then click “No”.

12. Wait for the ATM to issue your card and pick it up.

Cash withdrawals on the example of Bangkok Bank

1. Insert a bank card and wait for the prompt to enter a PIN code.

2. Enter your PIN.

3. Press the corresponding “Enter” button.

4. Select "English" or another language you know.

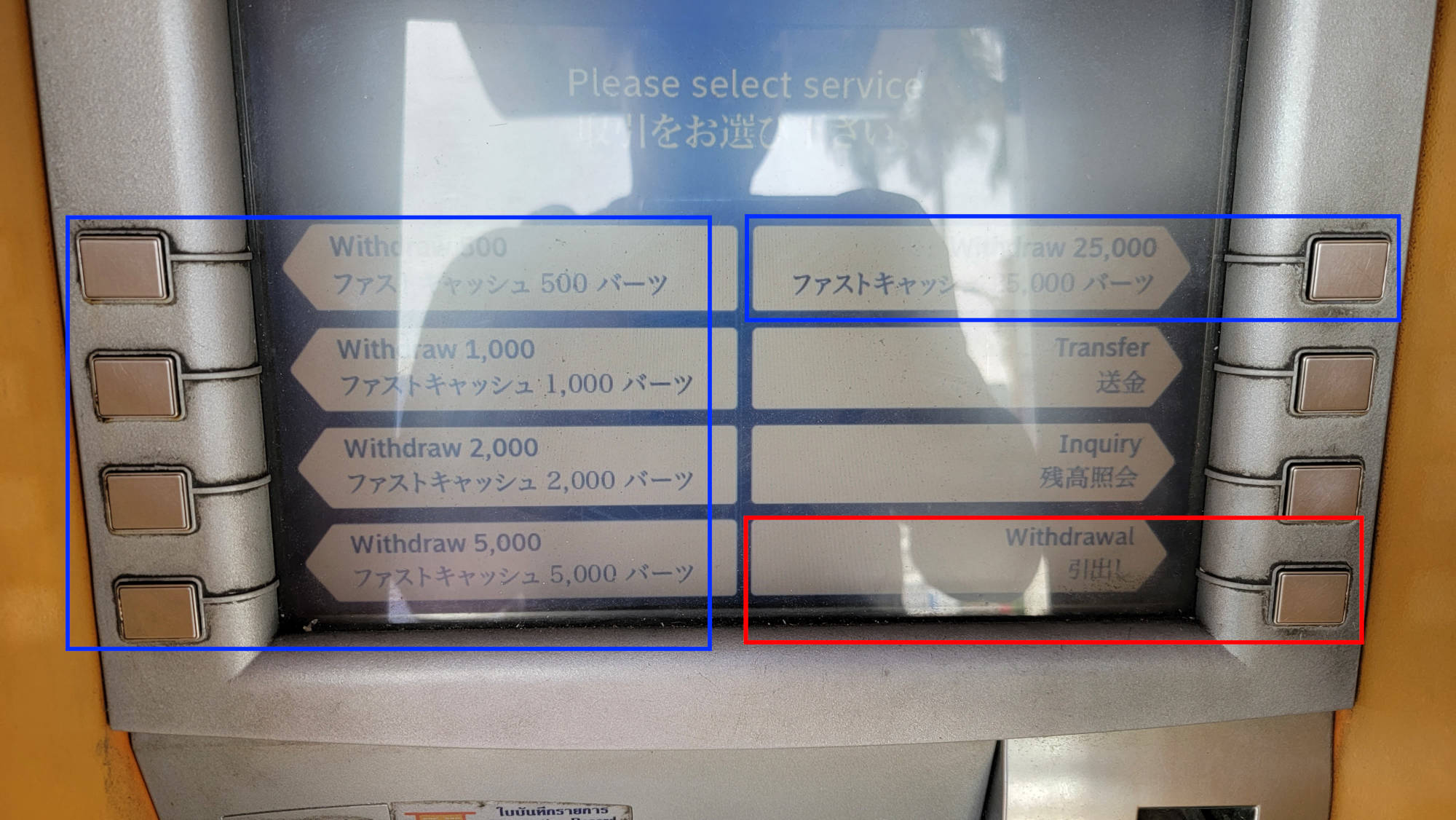

5. At this stage, you can either select the amount and withdraw cash (work with the ATM will be completed). If you want to withdraw another amount than the offered amount, then click “Withdrawal”.

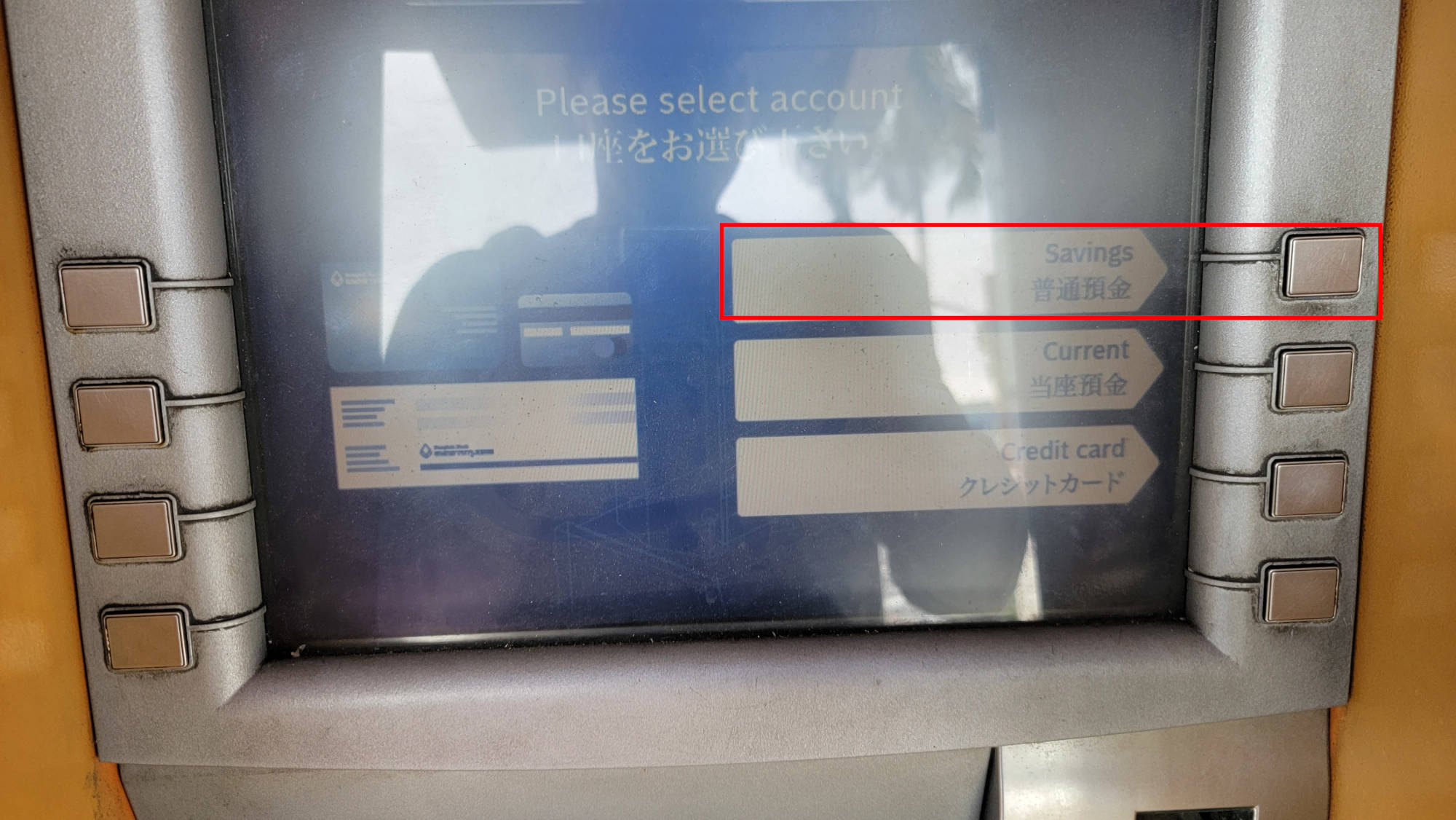

6. Select “Savings”.

7. Enter the amount you wish to withdraw.

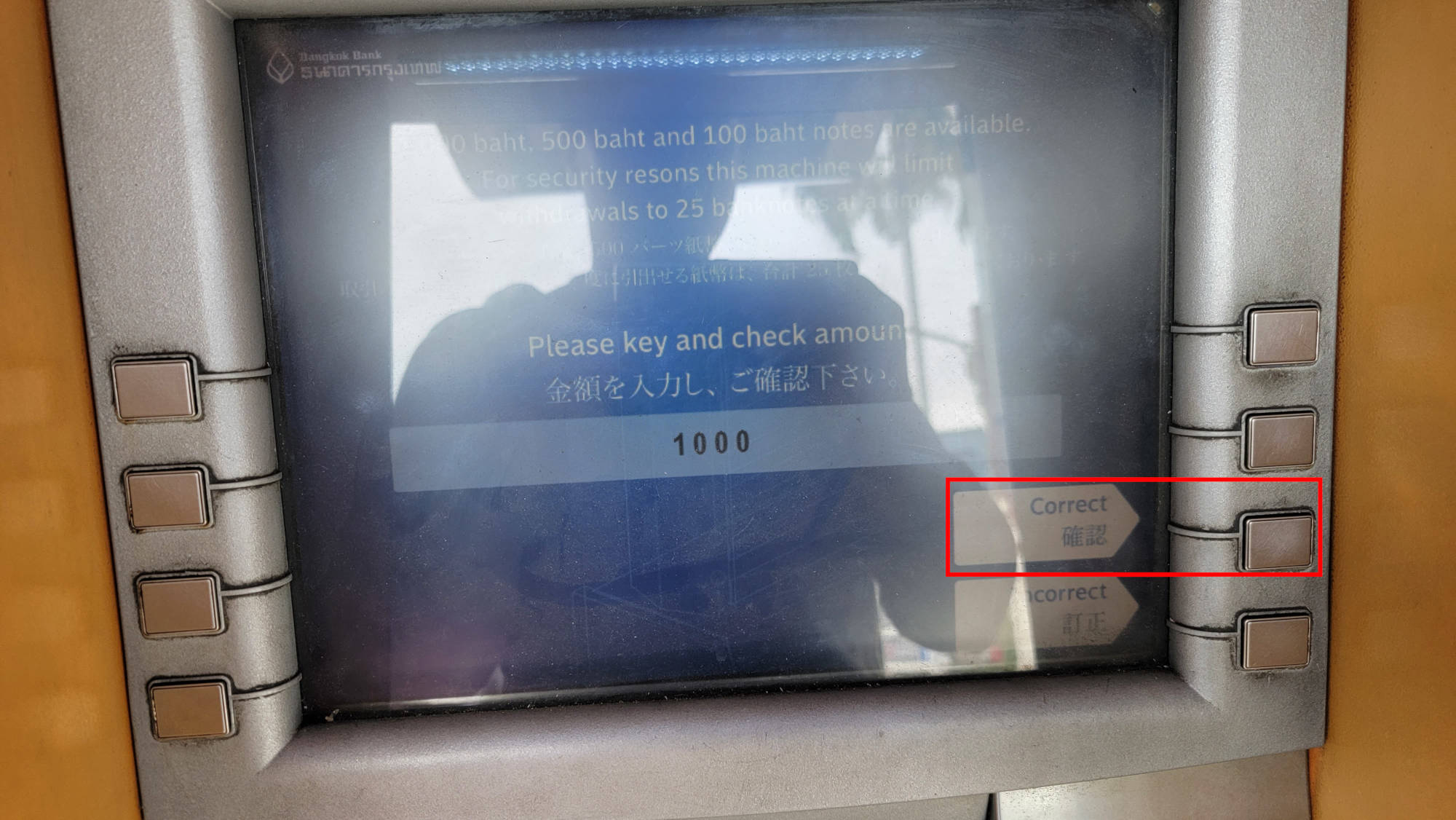

8. Click the “Correct” button.

9. Wait for the ATM to complete its work.

10. Take your money.

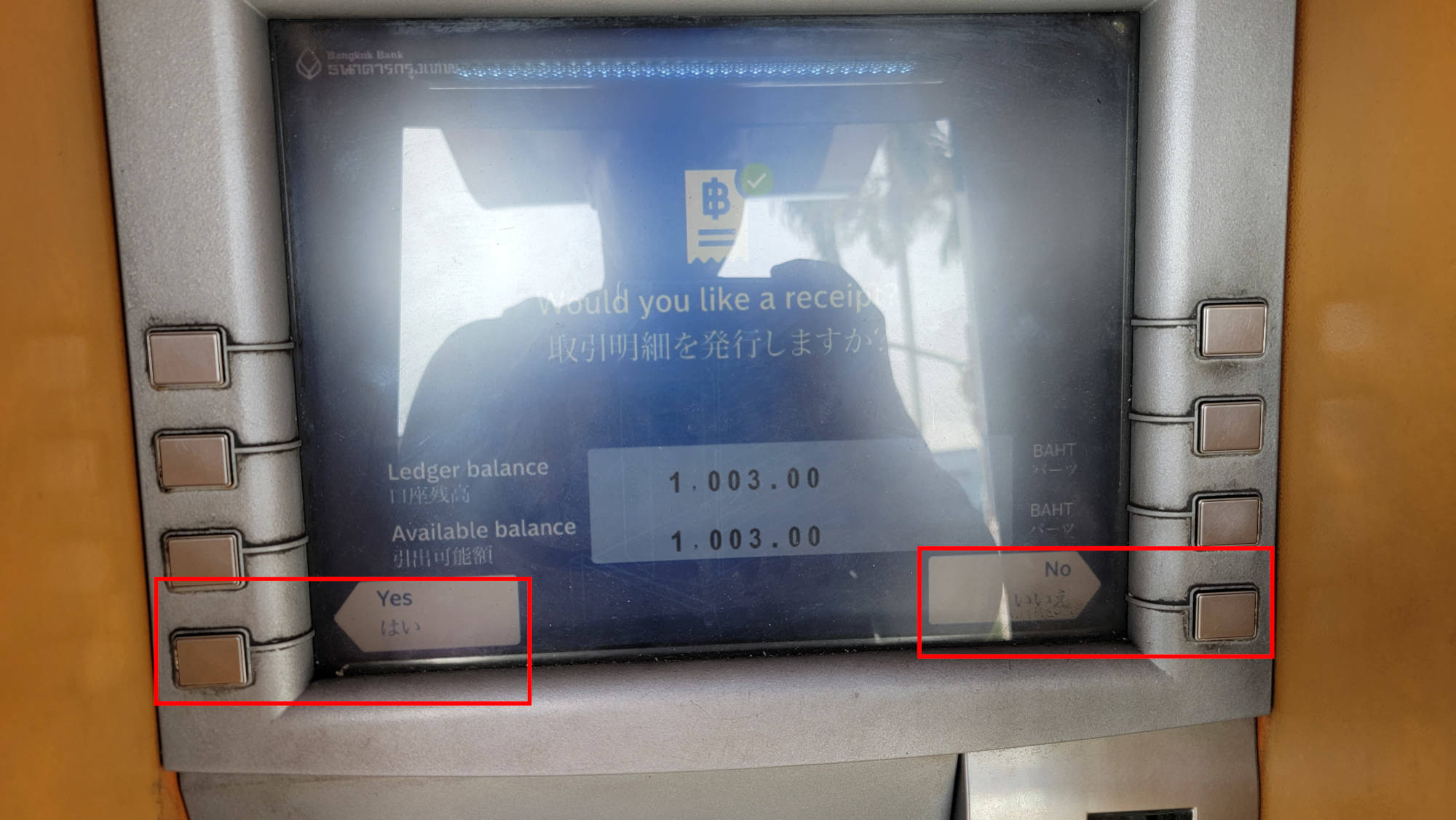

11. 11. If you need a receipt, click “Yes”, if you do not need a receipt, then click “No”.

12. Wait for the ATM to issue your card and pick it up.

How to transfer money to a bank account in Thailand from abroad

Using cryptocurrency, you can make international money transfers with minimal commissions and at the most favorable (for you) exchange rates. Thanks to the anonymity of cryptocurrencies, you can transfer money from one country to another without going through validation. See the article for details: Alternative to LocalBitcoins: instructions for using LocalCoinSwap.com

Tickets for buses, ferries and trains, including connecting routes:

Air tickets to international and local destinations at the lowest prices:

Related articles:

- How to generate a QR code to receive bank transfers in Thailand (91.6%)

- How to update entries in Passbook (Bank book) (90.5%)

- How to deposit or send money to a bank account in Thailand without a bank card and without opening an account (90.5%)

- Facial identification for transfers over 50,000 baht in Thai banks (82.1%)

- How to update passport information at a Thai bank (72.6%)

- Can a foreigner get a credit card in Thailand. How to get a credit card in Thailand (RANDOM - 53.3%)

Added some more examples of different types of ATMs in Thailand.